For traders targeting opportunities in a volatile market, SQQQ presents itself as a potent weapon. This triple-leveraged security provides increased leverage to the inverse performance of the Nasdaq 100. While caution is advised, SQQQ can be a valuable instrument for experienced traders looking to capitalize on bearish trends. It's important to meticulously analyze risk management strategies before participating in this type of trading.

Exploiting SQQQ's 3x Leverage in a Short QQQ Market

In the volatile world of stock/equities/markets, savvy investors are constantly searching for strategies/opportunities/tactics to maximize/amplify/enhance their returns. One such approach involves leveraging/utilizing/exploiting exchange-traded funds (ETFs) like SQQQ, which offers 3x short exposure to the Nasdaq 100 index (the/this/that QQQ). When the QQQ market shows signs of weakness or potential/anticipated/expected decline, SQQQ presents a compelling vehicle/tool/instrument for traders seeking to profit/capitalize/benefit from the downtrend.

However/Nevertheless/Nonetheless, employing/utilizing/implementing leverage comes with inherent risks/dangers/challenges. SQQQ's 3x multiplier can exacerbate/amplify/intensify both profits and losses, making it crucial for traders to possess/have/demonstrate a strong understanding of market dynamics and risk management principles.

- Careful/Thorough/Meticulous monitoring/observation/analysis of market trends and news events is essential to determine/identify/assess optimal entry and exit points.

- Position sizing/Risk allocation/Capital management plays a vital role in mitigating potential losses. It's crucial to limit/control/restrict exposure based on individual risk tolerance and overall portfolio structure/composition/allocation.

- Stop-loss orders/Protective measures/Trailing stops can help automatically/promptly/rapidly exit trades when predefined threshold/levels/boundaries are reached, minimizing/reducing/controlling potential downside.

ProShares UltraPro Short QQQ: Amplified Downward Movement

The ProShares UltraPro Short QQQ ETF, often described as an instrument, provides investors with a powerful way to profit from potential declines in the Nasdaq-100 Index. This amplified ETF aims to deliver three times the inverse daily returns of the QQQ, SQQQ ETF returns making it a high-risk option for traders seeking bearish exposure.

- Despite this, it's essential for investors to carefully consider the complexities of leveraged ETFs before utilizing them in their portfolio.

- Because of its multiples structure, the ETF's outcomes can fluctuate significantly on a daily basis, potentially leading to substantial gains.

Consequently, ProShares UltraPro Short QQQ should only be considered by experienced traders with a high tolerance for risk and a clear understanding of its inherent fluctuations.

Exploiting Nasdaq Declines with SQQQ: A Bearish Strategy

As the Nasdaq fluctuates, investors seeking to harness this volatility turn their attention to bearish instruments like SQQQ. This triple-leveraged ETF offers magnified exposure to the inverse of the Invesco QQQ Trust (QQQ), allowing traders to potentially exploit Nasdaq declines. However, it's crucial to understand the significant challenges associated with this approach.

SQQQ's magnification can be both a blessing and a curse. While gains escalate during downturns, losses can swell exponentially. Additionally, the ETF's performance is influenced by daily resets, meaning its returns are not always directly proportional with the Nasdaq's movement.

Therefore, traders must approach SQQQ with extreme caution. Comprehensive analysis of market conditions, risk tolerance, and trading aims is paramount before utilizing this volatile strategy.

The Potential of SQQQ: Profiting from Nasdaq Weakness

In the dynamic world of finance, where market fluctuations are a constant companion, investors strive opportunities to capitalize even during periods of downturn. One such instrument is SQQQ, a leveraged exchange-traded fund designed to magnify the inverse returns of the Nasdaq 100 Index. While the Nasdaq has historically been known for its strong growth, periods of weakness can present attractive opportunities for savvy investors looking to mitigate risk or even earn profits through a calculated approach.

- Leverage: SQQQ offers up to 3x leverage, meaning its returns are corresponding to three times the daily performance of the Nasdaq 100. This can lead significant returns during market declines.

- Portfolio Protection: SQQQ can serve as a hedge against potential losses in your portfolio if you hold positions in Nasdaq-related stocks or ETFs. By shorting the index, SQQQ helps to offset potential losses.

- Market Awareness: Understanding market trends and spotting potential weaknesses in the Nasdaq is crucial for effectively utilizing SQQQ. Investors should evaluate economic indicators, news events, and technical signals to determine appropriate trading points.

However, it's important to remember that SQQQ is a high-risk vehicle. Its leverage can exacerbate losses as well as gains. Investors should thoroughly consider their risk tolerance and trading strategies before deploying capital to SQQQ.

Amplify Your Nasdaq Inverse Strategy with SQQQ ETF

The tech-heavy Nasdaq has seen astronomical growth in recent years, but traders are becoming increasingly concerned. For those predicting a dip in the Nasdaq's price, the SQQQ ETF offers a powerful mechanism to hedge risk or even capitalize from a {bearishmarket. SQQQ provides leverage by shorting the Nasdaq 100 Index, meaning that when the index declines, SQQQ's value soars.

However, it's crucial to understand that SQQQ is a volatile investment. Leverage works both ways, meaning that losses can be considerable as well. Rigorous research and informed risk management are essential before participating with SQQQ or any other leveraged ETF.

- Consider your risk tolerance carefully before investing in SQQQ.

- Monitor market trends of the Nasdaq 100 Index and SQQQ's movements.

- Diversify your portfolio to minimize potential losses.

SQQQ can be a {valuable{ tool for experienced investors seeking to hedge against market risk, but it's not suitable for everyone. {Proceed with caution and always consult with a qualified financial advisor before making any investment decisions.

{ Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Rick Moranis Then & Now!

Rick Moranis Then & Now! Alicia Silverstone Then & Now!

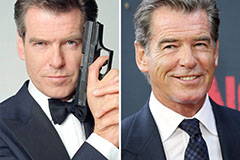

Alicia Silverstone Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!